Understanding Payment Reconciliation and Its Purpose

Understanding Payment Reconciliation and Its Purpose

People are at the core of every company, but cash flow and account management keep everything running smoothly. Accounting methods that are up to date and well-documented ensure that businesses operate smoothly and are well-positioned for development. Establishing a comprehensive payment reconciliation protocol is an essential accounting method to adopt for securing the financial health of your business.

In this blog, we’ll go through the fundamentals of payment reconciliation, why it's vital to have a payment reconciliation process, how it works, best practices, and, ultimately, how to automate it.

What is Payment Reconciliation?

Payment reconciliation is an accounting process that checks account balances to ensure that all records are accurate, consistent, and current Accounts can be reconciled on a daily, weekly, or monthly basis. It's best to do it as frequently as possible (once a week), but if that's not possible, you should at least do it once a month.

Disparities are common, and many of them are inconsequential. For example, payment timing, deposits, and delayed transactions can all have an impact on bank account bottom lines. Businesses, on the other hand, can utilise the reconciliation process to detect and prevent balance sheet errors, identify fraud, track down rejected payments, and track down late bills.

In essence, payment reconciliation is a bookkeeping procedure that compares internal financial information with bank statements to ensure that the accounting is correct.

For instance, when a bank statement arrives, costs and payments are compared to ensure everything is in order.

Payment Reconciliation vs Account Reconciliation

Reconciliation is an accounting process where you make sure all records tally up. This means checking your bank statements and balance sheet with any invoices or payments from vendors, which will let you know if there are any differences in expenses versus income over the course of one year. This can help keep track of the business expenses and income report.

Unlike account reconciliation which concerns reconciling your user accounts, payment reconciliation is reconciling your internal accounts with invoices and bank statements. And similar to account reconciliation, you should do this at least once a month. If you're doing it manually, you'll need to look for inaccuracies (on your balance sheet, from the bank, from invoices, etc.), investigate possible fraud, investigate missed payments, and chase down outstanding invoices.

Why Do Companies Need Payment Reconciliation?

Keeping strong, accurate records is one of the most critical things any organization can do, despite the fact that it may appear to be a tedious job. It's too easy to make an entry mistake, misplace a receipt, or account for a payment that isn't a company expense at all.

The following section dives deeper into why payment reconciliation has become a need for companies-

1.)Payment reconciliation reveals errors and unauthorised payments- Reconciliation is a financial merry-go-round that keeps you on top of your business's finances. Comparing internal and external records will catch any errors sooner, ensuring faster resolution for both cash flow problems as well as unauthorised payments or security breaches at your banks.

2.)Payment reconciliation helps to track unpaid or late invoices- By regularly reconciling your accounts, you can make sure every missed or late invoice is followed-up and settled. This will save time in the future when chasing down payment for these items as well as prevent you from worrying about it further.

3.)Payment reconciliation gives your business accurate financial records- Keeping your finances in check is essential for staying on top of your business. Accurate financial records will help you make informed decisions and demonstrate the healthiness or robustness of your business to banks, investors, and lenders when it comes time for them to look at how much money has been made by business ventures.

In some instances, there are regulations that require meticulous record-keeping. In these scenarios, precision is critical for preserving compliance and avoiding penalties for your company.

How Does The Payment Reconciliation Process Work?

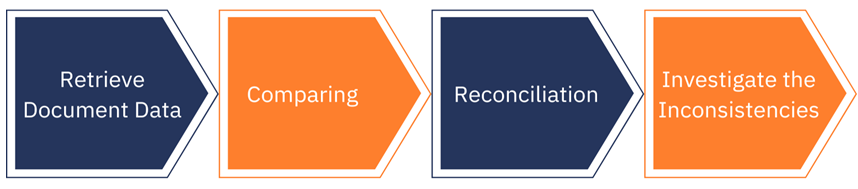

1.Retrieve document data- In this process, you will need to check your business transactions and invoices either from an accounting software or just a spreadsheet. You’ll then need to compare them against external records such as bank statements or other internal documents that are available for review within your company's system(s).

2.Comparing - The comparison process is essentially the process of comparing statements and diagrams at a transaction level, and is the second stage of reconciliation. The reconciling database is cleared of transactions that are obviously matched.

When datasets are simple and uncomplicated, comparing is usually done with Excel VBA programmes, but when datasets are related in a complex way, machine learning and AI methods may be helpful. Any discrepancies will be forwarded to the reconciliation stage.

3.Reconciliation- This is the most critical step in the process of reconciling items. Any inaccuracies will be reported to businesses or people for correction, followed by evaluations and approvals.

Because automated procedures fail to remedy the errors, this stage is particularly labour-intensive. As a result, optimizing the preceding two sets is critical to ensuring that the least amount of effort is required during this step.

4.Investigate the inconsistencies- You can then update the checking lists and entries when all of the work has been checked, and errors have been corrected. This step is simple enough that it can be completed entirely with the help of computer programmes.

Types of Payment Reconciliation

The meaning or definition of payment reconciliation, as well as the procedures in the account reconciliation process, may vary depending on the complexity of your firm and the types of payment transactions it processes.

The following are the types of payment reconciliation:

● Deposits

● eCommerce

● Brick and mortar stores

● Digital wallet reconciliation

● Disbursement transactions

● Bank account reconciliation

● Accounts receivable proceeds

● Global currencies reconciliation

● Account service and transaction fees

● Credit card and debit card reconciliation

● Real-time automatic payment reconciliation

● Cash, debit card, and credit card sales proceeds

Benefits of Payment Reconciliation

Whether accomplished manually for every bank account and payment method or automatically using a payment reconciliation system — payment reconciliation is always beneficial.

The following are some of the advantages of payment reconciliation:

● Time-efficient

● Results in real-time

● Prompt financial close of the month

● Error minimization

● Reduced Fraud

● Verification of the vendor

● Screening of global regulations

● Scanning for Tax IDs

● Payments that a financial institution has refused are identified.

● Information from tax returns

● Payment information

Pitfalls of Payment Reconciliation

1.)Your internal and external finances aren't linked from the start since you're continually chasing late payments. This makes reconciliation more difficult and leads to inaccuracies.

2.)If you’re unable to distinguish between which customers, clients, or vendors have paid you and which haven't it’s hard to trace the source of the discrepancy.

3.)Until the reconciliation is complete, you don't have a single reliable source of information. This means you need to jump between databases and spreadsheets to piece together the disparate bits of data;

4.)Your accounts aren't reconciled on a regular basis. When you finally settle down to work on it, the sheer number of transactions to complete overwhelms you.

Risks of Payment Reconciliation

● Delay and inaccuracy in payment reconciliation

● Delays in bulk payments to payees and missed payment discounts

● Reduced cash management visibility and lost payment discounts

● Delays in releasing month-end and year-end financial statements

Payment Reconciliation Best Practices

Reconciliation is an accounting process that must add to your company's profitability rather than subtract from it. Here are the two finest strategies for reconciling your accounts with the least amount of effort in order to maximize cash flow:

1.)High frequency is essential- Do not put off reconciling your finances till the end of the fiscal year. You'll have a pile of statements to sort through by then. So do it once a week instead. If that isn't practicable, try fortnightly or, at the very least, once a month.

2.)Automate payment reconciliation- You should ensure that you're giving stakeholders the most realistic picture of the company's current financial status. Automation is beneficial for enhanced accuracy and saving time for your team. However, manual processes are prone to human error, and discrepancies will arise if your co-workers approach reconciliation in diverse manners.

Now, you might consider how any firm has enough time to reconcile finances weekly? By streamlining and automating the procedure, unlocking increased profitability and financial growth requires a dependable inbound payment mechanism. You can also save money on payment administration by automating the process.

How Automation Can Help With Payment Reconciliation

While manual reconciliation may have been the norm for decades, automatic reconciliation has many benefits, including reducing human error. With an automated reconciliation, your team can focus efforts elsewhere, spending less time on a process you can easily manage through automation with tools like Billsby!

Semi-automated techniques such as ERP, accounting software, RPA, and cloud computing have been incorporated into reconciliation operations. The following section covers each of the programmes and how they help with reconciliation automation:

1.)ERP- Enterprise resource planning software enables organisations to plan and manage all of the core processes in an efficient manner. These include supply chain, manufacturing as well as financials for any individual activity or department within your business. This makes it easier than ever before because you can enter everything through one system, which will then generate reports on what needs to be done next with clear communication between departments involved.

2.)RPA- The use of robotic process automation (RPA) has been growing in recent years because it can replace human workers by emulating their behaviour with machine learning. Rather than creating a set of programs for each task, RPA learns from how humans interact through GUIs and, thus, performs tasks more efficiently without fatigue or error-prone input methods like typing entry after entry on spreadsheets, all while saving time!

3.)Accounting software- Accounting software is a collection and application software that aids in processing a transaction using typical accounting modules like account receivables, account payables, inventories, and so on. A good accounting software should enable you to reconcile transactions and accounts with minimum manual effort.

4.)Cloud computing- Cloud computing and storage are two services that are kept in sync over the internet. Based on conventional bookkeeping methods, which require all books to be held in one location for easy access at all times, cloud computing allows all data to be stored in the 'cloud' and accessed at any time. Because the database is the same for access at multiple locations, any checks in between are easier to conduct, overall process less error-prone. Lastly, cloud computing simplifies tracking all transactions generated by RPA and ERP.

Are you finding someone to automate the mundane, mechanical payment reconciliation process? Try Billsby!

Payment Reconciliation FAQs

1.)What does reconciliation mean?

Reconciliation is an accounting process that involves comparing and contrasting two sets of records, usually internal and external, to confirm that the data is accurate and consistent.

2.)What is balance sheet reconciliation?

Balance sheet reconciliation checks the balance sheet's accuracy by comparing the general ledger account reconciliation to other kinds of documentation and explaining any inconsistencies.

Conclusion

A decent payment reconciliation process clears up any ambiguity and ensures that all departments are on the same page.

The future of payment reconciliation looks positive due to advancements in both hardware and software.

Billsby integrates automatic reconciliation across all transactions and payment types into a single dashboard. By automating these operations, you may spend less on manual accounting and more on building your company.

Source - Payment Reconciliation

.jpg)

.webp)

Comments

Post a Comment